The sweet sixteen that will make you more profitable and expand your market share.

By Walter J. McDonald

Equipment Dealers want and need to know how to improve service labor sales and profitability. Some say nothing seems to work very well. I recently completed four consulting projects for equipment dealers and a series of five dealer workshops for an equipment manufacturer. All of these efforts were focused on improving service and parts operations. Working with these many dealers, we applied these 16 tools with very good results. You might be interested in what worked best.

1. Develop and Utilize a Customer Ranking Report by Aftermarket Service and Parts Sales Opportunity

Ranking service sales and parts sales direct to customers is nothing new. This is easily done to identify your largest current aftermarket accounts. The added, most useful dimension is determining “aftermarket potential” by account. Account aftermarket potential is based on the number of units he owns times an annual labor and parts “consumption factor.”

Your aftermarket sales opportunity is the account’s total potential, less your current service and parts sales to him. Rank service customers separately from parts direct customers who do their own maintenance. Which of your current accounts offer you the greatest incremental sales opportunity based on their current mix of units? This is extremely valuable information and enables a highly focused business aftermarket development effort based on just a little work in Excel.

Some manufacturers provide unit consumption data by equipment type to their dealers. If yours can’t, it’s not that difficult to approximate the amount. Two quick sources include your rental fleet and large customers who keep very accurate equipment maintenance records. You want to know how many labor hours and how many parts dollars one piece of each type of equipment consumes in a typical year. Earlier in Chapter 4, we examined some equipment consumption factors by product category.

Your estimate does not have to be exact. If you have many lines, first focus your efforts on your most populous units. If you sell underground tools such as directional drills and trenchers, they consume large amounts of parts and supplies annually. So, do parts and supplies separately. (Just remember: factors shown are averages for the useful life of the equipment. A 2-yr old unit will be much less.)

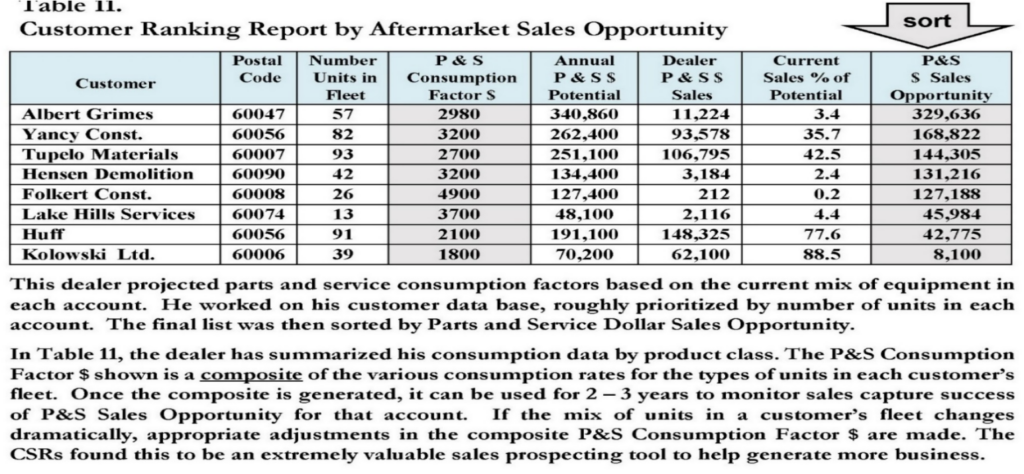

The resulting ranking report table is shown below. Identifying aftermarket customer sales opportunities is amazing because most likely no one in their service or parts operations ever considered a focused sales approach on those newly identified high-potential accounts.

For example, current aftermarket sales to Folkert are $212, yet their total potential, based on the number of units in their fleet, is $127,188. He sells only 0.2% of his potential. This ranking report highlights those opportunities.

2. Plot Aftermarket Customers on a Wall Map

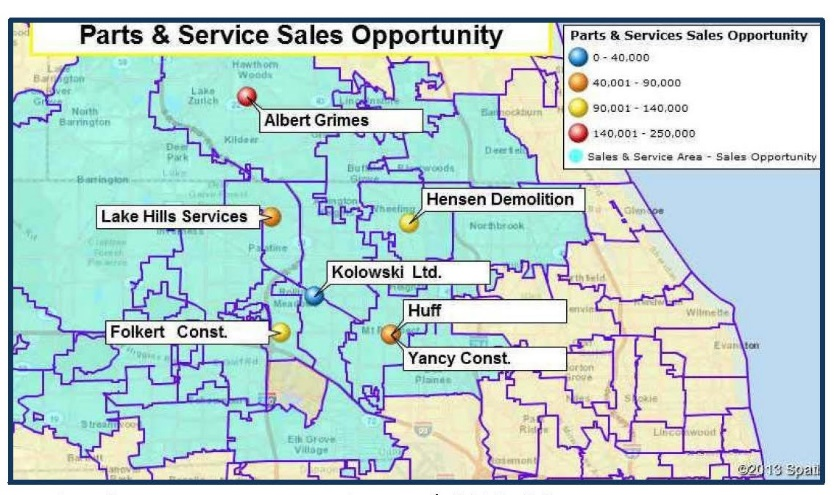

Wall Map of Aftermarket Customers

Many dealers find it extremely useful and informative to create a large wall map of at least 24” x 30” representing customer locations. This tool assists you in defining aftermarket sales opportunities. Managers find it easier to visualize geographic clusters of opportunity on a map vs. a columnar list of customers and prospects. See sample map above.

Very inexpensive software and printing resources are now available to create informative and helpful tools to assist and plan sales and customer support campaigns. Accounts can be indicated on the maps by a wide variety of symbols, sizes, and colors.

A reasonably priced map resource is Map Business On-Line, mapbusinessonline.com. This web-based mapping software is a very user-friendly program that supports both Windows and Macintosh web browsers. Business data can be easily imported from Excel spreadsheets or text files. The user can save maps as

Jpegjpeg, PNG, or PDF images. An annual subscription in 2015 for a single user costs is very reasonable.

Then, working from your PDF map file provided by mapbusinessonline.com, Office Max can print color images from 24” wide to up to 60” in length for just a few dollars each. Call first to make sure their printer person is available.

Three of the most useful maps we helped some dealers develop include:

Map A: All dealer equipment customers by location. Four current fleet size categories by symbol size. Indicate “Yes/No PM Contract” by symbol color. The dealer could immediately see which large machinery customers were under PM agreements or not.

Map B: All current aftermarket customers by location. Four current customer fleet size categories in units by symbol color. Current P&S sales opportunity potential is shown by symbol size. This dealer saw where large aftermarket sales opportunities were located.

Map C: All Parts Direct customers by location. If you have numerous parts-only accounts that do their own maintenance, do one map for them. Indicate parts sales potential by symbol size and a special symbol color for prospective target accounts.

Using these tools, a dealer can easily determine where his large aftermarket parts direct sales opportunities are located. Some of the remote locations need special order/receipt/delivery arrangements or consignment inventory accommodations for their distant location.

3. Profile Your Largest Aftermarket Sales Opportunity Customers

Who are the key players and aftermarket purchase influencers? How can you find them? Where are they? What is the nature of their fleet, vocation, application, equipment utilization, work environment, maintenance issues, downtime, emergency service history, and current maintenance practice? What is their attitude toward your dealership? What is their payment history? What are their email addresses?

If you would like a handy profile worksheet to help you get better acquainted with these important accounts, an excellent eight-page key account profile is in my Workbook for Achieving Excellence in Dealer/Distributor Performance. It was developed by several teams of successful dealer managers over several workshops. Unfortunately, most dealers maintain a very poor qualitative information database on these high-value accounts. And, most often, their best customer information is in a past due receivables collection file for deadbeats or in the trunk of your vacationing sales rep.

If you don’t have computer customer profiles, I recommend Product Support Managers maintain a 3-ring binder on the credenza for profiles of the top 50 Service accounts and top 50 Parts accounts. This is an excellent first step toward a more sophisticated automated Customer Relationship Management system.

When a customer telephones you, grab your 3-ring Key Account Profile binder. Refer to his page for information on his business, his hobbies, his family, his fleet, etc. Customers will be amazed by your knowledge and insight.

4. Build Up-Time Strategies for Your Largest Aftermarket Accounts

Remember, you are not in the business to sell parts or service. You are in the business to sell up-time and productivity improvements. Once you help your account determine his hourly cost of downtime, you can build a very persuasive case for your “fix before fail” maintenance support efforts. These can include everything from periodic inspections to a full-scale PM Program with oil analysis. Your “fix before fail” strategies enable you to schedule and make essential repairs at your customer’s convenience as well as yours. This greatly reduces fire drills in mid-season, ensuring higher levels of customer satisfaction. You become a strategic partner with your most important accounts.

5. Organize and Present Executive Level Recommendations

Your top 25 high-potential aftermarket accounts deserve a thoughtfully prepared and presented “Maintenance Cost Reduction Strategy” presentation by your top executives including your Dealer Principal, Service Manager, Sales Manager, and Field Sales Rep. Come prepared with an analysis of 12 months of their repair order maintenance cost history.

Determine what repair order cost was incurred through normal wear and tear, what amount of the total was due to poor maintenance practices, and what cost was caused by operator abuse. As much as 40% of their maintenance cost could fall into those second two, controllable expense categories.

Refer back to Chapter 5, page 89, and the sidebar “Key Account Aftermarket Management Strategy.”

Offer suggestions on how you can team up with them to manage and control these costs through better “fix before fail” maintenance procedures, operator training, and closer monitoring of unit life-cycle costing. See Chapter 23, page 256, on equipment life-cycle costing techniques. This is a simple economic model that illustrates when a unit should be replaced based on cost over time.

6. Expand PM Program to All Accounts

Once you have successfully implemented your “fix before fail” strategies for your highest aftermarket sales opportunity accounts, roll it out to second and third-tier customers. Use your map of “account clusters” so that you can promote and sell PM Programs in confined geographic areas to facilitate efficient completion of scheduled inspections.

If you are really hungry and aggressive, conduct a full market census of competitive users, Chapter 12, page 168, offers comprehensive directions on current and prospective customer market research and perception studies. A part-time student intern with a good telephone personality works well. Then, based on the vulnerability of your competitors and their aftermarket reputation, pursue maintenance business from their accounts using all the tools mentioned above. Best prospects can be mapped to facilitate coverage. If your OEM doesn’t sell competitive parts, they can be obtained from a dealer out-of-state at a discount or an all-makes parts wholesaler.

7. Upgrade and Refine Inspection Procedures

The way to derive the most benefit from “fix before fail” is through comprehensive inspections. Do you have a good one for each type of equipment you sell? Is it current? Are your technicians trained to complete it properly? Do they know the very best way to present their recommendations to the customer? Remember, your field service technicians can have the highest level of credibility with customers. Higher than anyone else in your business! Customers will listen to them. And, the implications of this are huge.

CAUTION: Never, never, never allow a very angry, disgruntled field service technician anywhere near one of your accounts. Horror stores are endless.

8. Track 2nd Segment Work

Your 2nd segment work is the service and parts sales generated through equipment inspections. These sales should be tracked by technician, by customer, and overall average per inspection. Your team will quickly see the sales value of each inspection and will encourage managers to ensure that your technicians are properly trained with the right inspection forms.

This must be accomplished through software, otherwise, the data collection is very tedious. However, being able to analyze 2nd segment work is definitely worth the time and resources.In addition, each incremental dollar of billing also carries through parts sales at full gross profit margin. If a dealer really wants to increase profitability, the first place to look is improving service labor productivity.

9. Establish productivity and efficiency standards for technicians

The three most important metrics for technicians are productivity, monthly dollar billing, and efficiency. Productivity is weekly hours billed ÷ hours available. Monthly dollar billing is the total labor sales for that technician that month. Efficiency should be calculated for each job and weekly overall: Estimated Time vs. Actual Time.

Efficiency = Estimated Time ÷ Actual Time on this job and all jobs for the period. As more and more dealers are able to improve their data on estimated times, you will benefit by being able to provide more accurate customer estimates. In addition, you will have a valuable tool to identify technician problems and training needs.

Remember: Each incremental dollar of billing achieved through increases in technician productivity incurs zero cost! In addition, each incremental dollar of billing also carries through parts sales at full gross profit margin. If a dealer really wants to increase profitability, the first place to look is improving service labor productivity.

10. Set minimum monthly dollar billing goals per technician per month

If not performing at this level, you need to find out why quickly. And, you do not want to waste their time on facilities maintenance, landscaping, and other non-revenue producing activities. This requires close supervision to prevent padding job times. Accurate job estimates will help.

11. Work on off-shelf parts fill rate to service

We found that as much as 50% of improvements in labor productivity can be attributed to better supervision with performance metrics. And, 50% can be directly attributed to improved off-shelf parts fill rate to the service department. Your immediate off-shelf parts availability to support primary lines should be well over 90%. If not, determine why. Then fix it.

12. Eliminate dead stock that compromises working capital

One of the big reasons why fill rates can be low is that a large portion of your inventory is dead. We just worked with one dealer in which 28% of his stock had zero movement in 12 months. And, this excluded protected stock for new models. Considering direct and indirect and opportunity costs, his $385,000 in dead stock was costing him $481,000 every year. And, it crunched his inventory turns down to 2.3.

13. Structure long-term customer retention best practices

What are you doing to defend the service and parts customers you already have? Are you building a high level of product support and customer service? Have you constructed such a robust, protective defensive perimeter around your customer base that you can ward off all competitors? Remember, low price is a terrible defensive strategy. Excellence in product support is the best.

14. Build and maintain key account relationships

Top executives in your dealership should meet with your 25 most important accounts in a formal review at least twice a year at first, then according to the frequency desired by each of these accounts. The one question you want to be answered in great detail: “Other than price, what can we do to help you increase productivity, reduce cost and make more money?”

15. Track overall aftermarket product support metrics

Today, the computer is the great equalizer. Even the smallest dealer can afford a management information system to provide essential data to deliver excellence in your service and parts operations. The rule of thumb is that your new information systems investment returns about four times the cost. We have covered most of the essential metrics in this dealer guide. The important point is that if you can’t measure it, you can’t manage it!

16. Maintain a Regular Cadence of email Promotions

In combination with the other marketing support programs mentioned above, nothing is more effective and powerful than a regular, frequent schedule of email promotions. This, however, requires a disciplined approach to capturing email addresses by all hands in the dealership, especially sales and parts. You should strive to capture emails of 95% of current customers and prospects. In larger accounts, get emails of all “influencers.”

As you will see in the bombshell report by Debbie Frakes in the next article, the ROI for dealer email promotions is through the roof. However, the one mistake I see in execution preventing full achievement of universal benefits for the dealership is limiting the email promotions to just new and used machinery sales. What about rentals? What about parts? What about service?

Please contact me if you would like to discuss any aspect of this article: walt@mcdonaldgroupinc.com.

Portions of this paper originally appeared in my textbook, Service Management: The Machinery Dealer Manager’s Handbook, available on our website Service Management – The McDonald Group Inc