Digital Transformation

Digital transformation has become a popular business term and activity. These changes require a willingness to unlearn the old ways and learn the new ways of doing business in a ‘being digital’ world. Dealerships usually adopt digital to do the things they already do, only better, faster, easier, and cheaper. Thereby, digitization increases revenues, profits, and organizational health. This article explores Returns on Digital Investments (RoDI) linked to digital transformation.

Business strategy is connected to markets, products and services, and capabilities. Digital investments by a dealership are made to build and power capabilities!

Business strategy and its digital strategy should drive and direct digital investments, while investments should enable and enhance strategy. Digital investments are spending on information, process, product, and communication technologies.

The specific technologies that add business value are contingent on the dealer situation and circumstances. The three foundational (transformative) technologies for a machinery dealer are enterprise resource planning (ERP), cloud computing, and customer relationship management (CRM). Eleven customer and internal support (extend) technologies are:

- Internet of things;

- Data security;

- Business analytics;

- Supplier relationship management;

- Website commerce;

- Collaboration tools;

- Digital marketing/social media;

- Mobility;

- Robotic process automation;

- Artificial intelligence; and

- Advanced wireless.

Dealers need to get smart on these available technologies and their relevant use cases. Technology choices must be grounded in deep understandings of both.

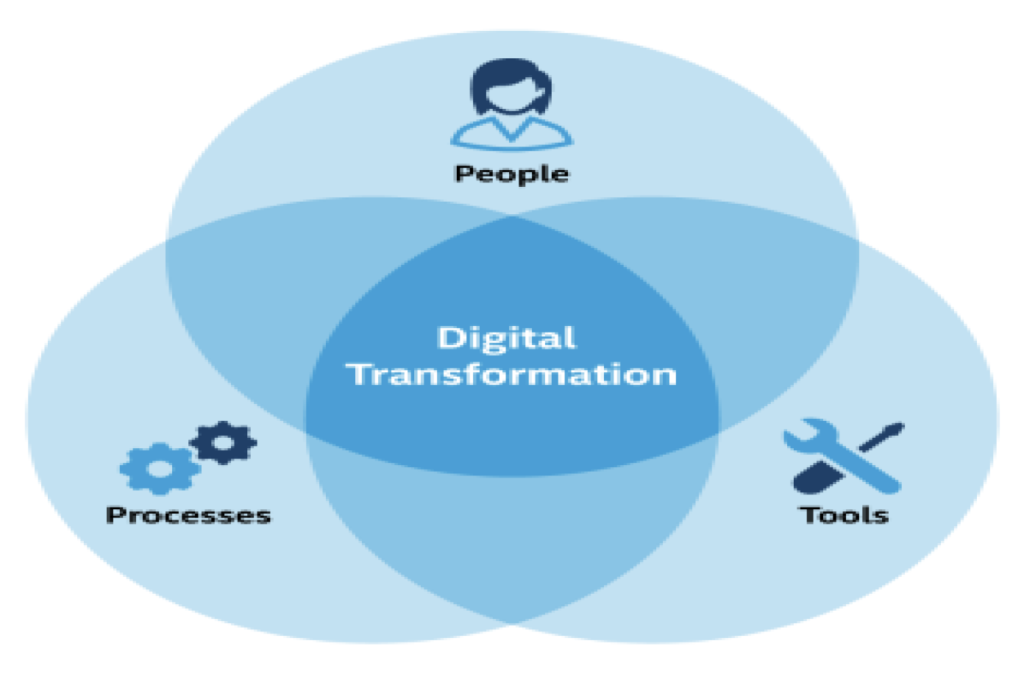

Digital transformation starts with identifying the critical business needs, then adopting processes and technologies (tools and data) that address those needs, and lastly fostering an organizational culture that can rapidly accept and adapt to technological disruption. These three things—tools, processes, and people (as illustrated in Exhibit 1 below) combine to solve top business problems and can provide substantial value to the machinery dealer.

Exhibit 1: Digital Transformation Framework

Digital Strategy

The digital strategy must fit and align with the business strategy. A digital strategy contains a portfolio of digital investments and sets the spend agenda. The strategy needs to consider primary business focus (customer and internal) and primary business impact (revenues and costs). Factors determining investments are:

- Speed: Faster decisions, faster responses, faster cycles;

- Cost reduction: Same outputs with less inputs;

- Productivity: More outputs with same inputs; and

- Customer focus: Interactions from marketing to sales to service.

A dealership should have a balanced mix of these four factors for their investments. A key to selecting the strategy, right initiatives, and priorities is to thoroughly assess the current digital state at the dealership. This is often referred to as the level of digital maturity and it determines the readiness of an organization for its next digital moves.

Exhibit 2 (below) shows a digital strategy framework where there should be priorities and investments in each cell. The business case for a specific investment starts with the digital strategy.

Exhibit 2: The Digital Strategy Matrix

Project Metrics

In a cash-constrained and resource-limited environment, proving the value of all investments, especially digital, takes on increased importance. For digital, it is important to clearly define the right project-specific metrics and time lines for achieving the desired change. In most cases, the metrics should be tangible and quantifiable, but in the more innovative, disruptive initiatives, they may be more qualitative, as when measuring customer perception. Whether progress is measured through soft or hard metrics, the goal of every initiative should be to link and support the company’s overall strategic goals.

Digital investments are no different when it comes to determining returns from proposed projects. To estimate returns on digital investments (RoDI), dealers should use the standard evaluation approaches, such as payback, net present value, and benefit-cost ratio. Digital initiatives need to be assessed according to the cash flows they generate and use. The expected returns should demonstrate confidence that they can be achieved and sustained. The digital returns need to be compared to an alternative, such as no-change base case, or against other investments competing for scarce resources. These justifications can help distinguish value-creating digital initiatives from value- destroying ones. However, there may be strategic reasons to make a digital move, even when the financial analysis presents negative results.

RoDI is difficult to calculate, because the future is uncertain. Surveys show that executives actively measure the return on investment for their digital initiatives, though other key performance indicators (KPIs) are more common than RoDI, including KPIs about sales performance, financial results, customer feedback, and operational efficiency (such as process simplification and standardization).

Some technology investments are made to maintain (run) the business-as-usual. For example, cybersecurity is usually a top spend without formal economic justification and metrics, since specific cybercrime threats and consequences are unknown for a particular dealer.

In practice, everything can have numbers, both benefits and costs for financial analysis. These metrics that matter need to be credible and reasonable estimates that can be tracked. Results tracking activities include anything related to quantifying, validating, or reporting transformation status, from progress on specific initiatives to sentiment of employees. Results tracking on a consistent cadence is also critical to any course-corrections needed in the event that results are not being realized on schedule.

RoDI Example

A machinery dealer is considering a cloud-based CRM solution to improve the deteriorating customer retention situation. The management team evaluates three vendors, collects costs, and identifies benefits. The stable costs include service subscription fees, plus CRM implementation, training, and ongoing upkeep costs. The benefits include margin improvements (more dollars) from increasing customer retention rates over time. Exhibit 3 (below) shows the classic cash flow analysis for this targeted illustration. The project should go forward, since the net present value is positive with moderate risk and potential solution is flexible.

Exhibit 3: Cash Flow Analysis

| Initial | Year 1 | Year 2 | Year 3 | Total | Present Value | |

| Total Costs | ($141,625) | ($361,675) | ($361,675) | ($361,675) | ($1,226,650) | ($1,041,057) |

| Total Benefits | $0 | $757,890 | $1,162,065 | $1,612,650 | $3,532,605 | $2,860,983 |

| Net Benefits | ($141,625) | $396,215 | $800,390 | $1,250,975 | $2,305,955 | $1,819,926 |

| RoDI | 175% | |||||

| Payback | 5 months |

Exhibit 3 Notes:

- Payback is ($141,625/$396,215) X 12 months/year and equals 5 months (rounded). Payback Period is the breakeven point for an investment and is the point in time at which net benefits (benefits minus costs) equal initial investment or cost.

- RoDI is ($1,819,926/$1,041,057) X 100% and equals 175% (rounded). Return on Digital Investment (RoDI) is project’s expected return in percentage terms and is calculated by dividing net benefits (benefits less costs) by costs.

- Discount rate is 10%. Discount Rate is the interest rate used in cash flow analysis to take into account the time value of money and organizations typically use discount rates between 8% and 16%.

- Present Value (PV) is the present or current value of (discounted) cost and benefit estimates given at an interest rate (the discount rate). The PV of costs and benefits feed into the total NPV of cash flows.

- Net Present Value (NPV): The present or current value of (discounted) future net cash flows given an interest rate (the discount rate). A positive project NPV normally indicates that the investment should be made.

The purpose of this executed and positive returns project was to unify and increase customer data that provided customer knowledge and analytical insights. To get these positive returns, this dealer adopted a bi-monthly investment review to assess and make decisions on the CRM commitment and its progress. The management team implemented the Objectives and Key Results (OKRs) framework to measure not only project costs and timelines, but also outcomes. OKRs describe a clearly defined objective and three-to-five key results that focus on outcomes and people, not process and tools.

Digital investments should be made in three spend categories: run, enhance, and grow the business. This example realized features and benefits for all three. Improving customer experience was a crucial goal – and thus a critical part of this focused digital transformation.

Investment Failures

Studies reveal that around 50% of dealers successfully capture value from their digital initiatives. Correspondingly, this means that about 50% are failures. Failure can be defined as negative returns where costs exceed benefits and includes abandoned projects. Success is commonly positive returns, even though the obtained returns may be less than those expected. As failure reasons demonstrate, digital is more than technology.

Research shows that there are numerous major reasons for digital transformation failures:

- Under-spending;

- Change in organizational priorities;

- Poor project management;• Lack of executive leadership;

- Ignoring lessons learned from other initiatives;

- Employee resistance;

- Selecting wrong vendor/software;

- Poor-quality and/or incomplete data;

- Missing human skills; plus

- Interoperability issues with and/or migration problems from legacy systems.

Digital Success

The technologies are widely available. Getting competitive differentiation and advantage from these technologies require effective adoptions and uses.

Successful digital transformation takes at least three things:

- Setting realistic aspirations and making urgent priorities;

- Committing investment and talent; and

- Using investments to get expected results.

Many dealers struggle to compute returns, because some of their investments have wide-ranging qualitative impacts that cannot be easily captured in quantitative calculations. All qualitative factors can be quantified based on business judgments.

Having a documented digital strategy and measuring the ‘before and after’ returns on digital investments are essential. The ‘before’ returns are necessary for project screening. Dealers should not only examine the value being provided by individual digital initiatives, but also at initiatives’ collective support of strategic organizational goals. Bear in mind that there is no such thing as standing still; and to make little or no investment relative to the competition is to fall further behind. Thus, digital investments are also about competitive loss avoidance.

Dr. Nick McGaughey, CPA provides research and consulting to manufacturers and distributors in a variety of industries. He has held management positions at Coopers & Lybrand and Grant Thornton, consulting positions at Booz-Allen & Hamilton and Stanford Research, engineering positions at Westinghouse Electric and AlliedSignal, and teaching appointments at University of San Francisco and University of Liverpool.

His educational background includes B.S. and M.S. in Engineering, M.B.A. and D.B.A. in Accounting, Ph.D. in Technology, Doctoral Specializations in Finance and Information Systems. Additionally, Dr. McGaughey is a Certified Public Accountant (C.P.A.). He has authored 68 publications and presentations.

Dr. McGaughey has extensive industrial and construction equipment experience and knowledge involving suppliers, manufacturers, and dealers. Clients have included Komatsu, Deere, Case, and Bobcat. Projects have included competitive investigations, business operations, channel assessments, financial strategies, and market research.